Music Streaming Services Stats (2025)

Music streaming has completely changed the music industry.

In fact, the vast majority of music listeners now rely on music streaming platforms.

The following report will dive into some of the most important industry statistics.

Contents:

Music Streaming Services (Top Stats)

- Music streaming makes up 84% of music industry revenue

- The music streaming industry grew by over 10% over the last year

- Music streaming’s global revenue currently sits at $17.5 billion

- Paid music streaming makes up 23% of all music streaming

- 78% of people listen to music via a streaming service

- Over 600 million subscribe to a music streaming platform

Music Streaming Industry

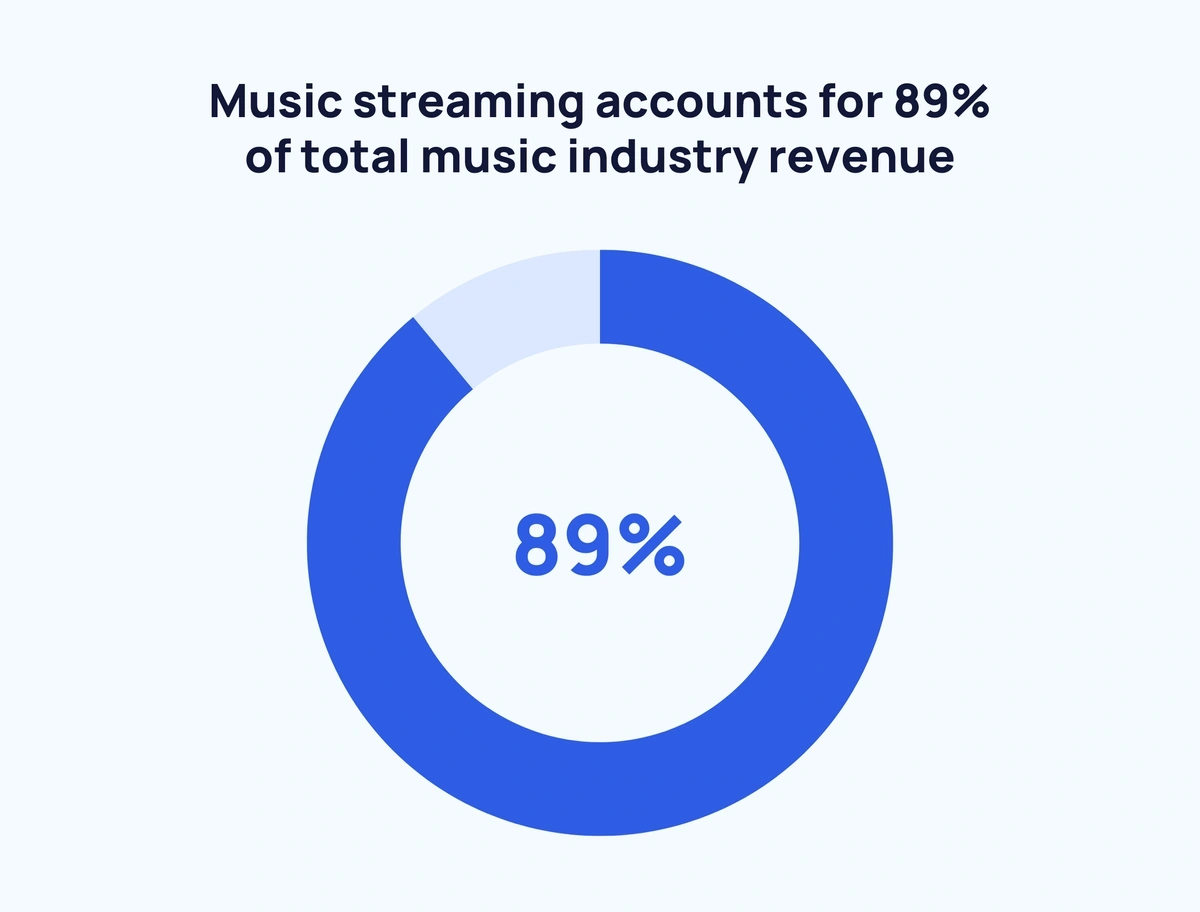

Music streaming accounts for 89% of total music industry revenue (Forbes)

Recent data shows that the music industry is heavily reliant on streaming.

Music streaming platforms grew by over 10% last year (IFPI)

According to IFPI’s Global Music Report 2024, music streaming services grew by 10.4% in 2023.

This follows a 10.2% increase in the global music industry as a whole – a 9th successive year of growth.

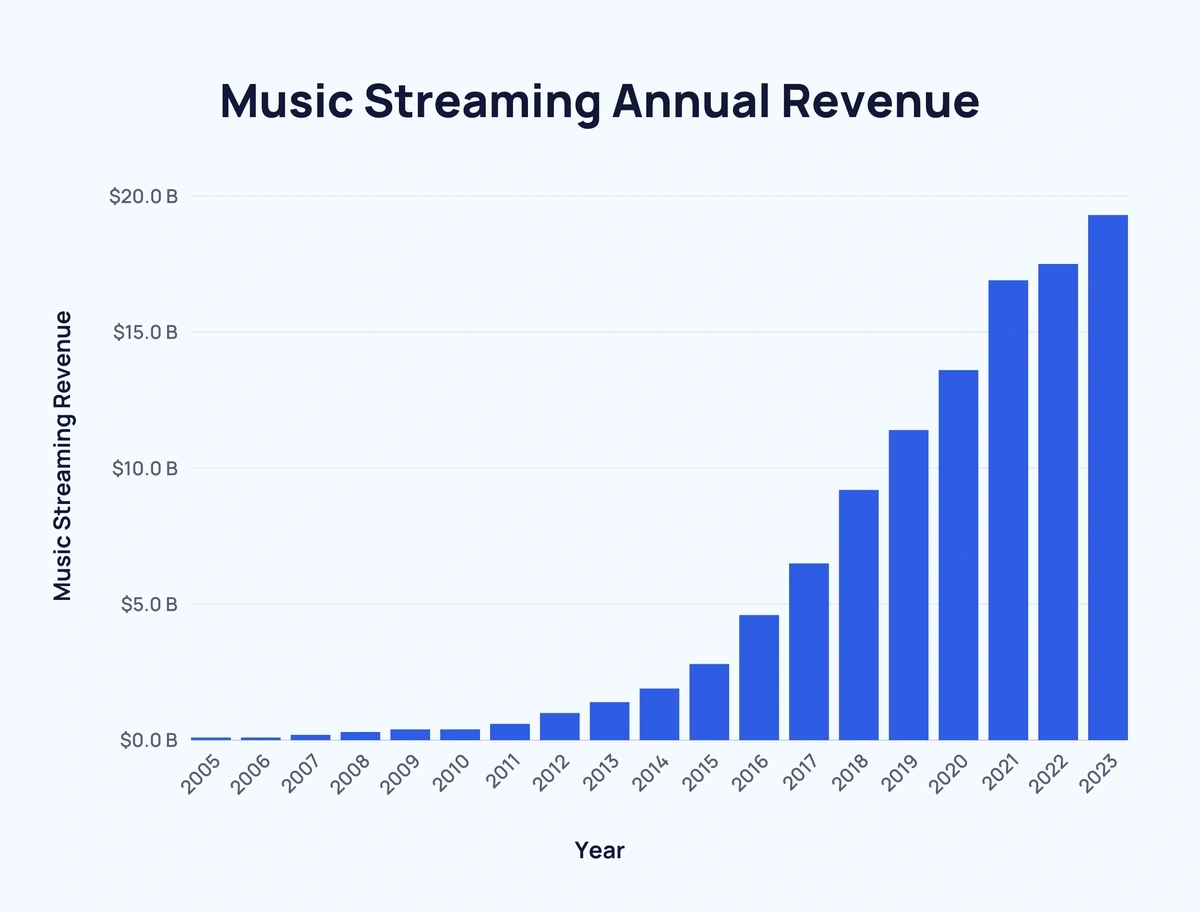

Music streaming revenue has surpassed $19 billion annually (IFPI)

Revenue from music streaming has grown year over year since the mid-2000s.

Between 2010 and 2020, revenue increased by around 34x from $0.4 billion to $13.6 billion.

And in 2023, music streaming revenue stood at approximately $19.3 billion.

Here’s a look at how music streaming revenue has increased over time:

| Year | Music Streaming Revenue |

| 2005 | $0.1 billion |

| 2006 | $0.1 billion |

| 2007 | $0.2 billion |

| 2008 | $0.3 billion |

| 2009 | $0.4 billion |

| 2010 | $0.4 billion |

| 2011 | $0.6 billion |

| 2012 | $1 billion |

| 2013 | $1.4 billion |

| 2014 | $1.9 billion |

| 2015 | $2.8 billion |

| 2016 | $4.6 billion |

| 2017 | $6.5 billion |

| 2018 | $9.2 billion |

| 2019 | $11.4 billion |

| 2020 | $13.6 billion |

| 2021 | $16.9 billion |

| 2022 | $17.5 billion |

| 2023 | $19.3 billion |

Music Streaming Market Share

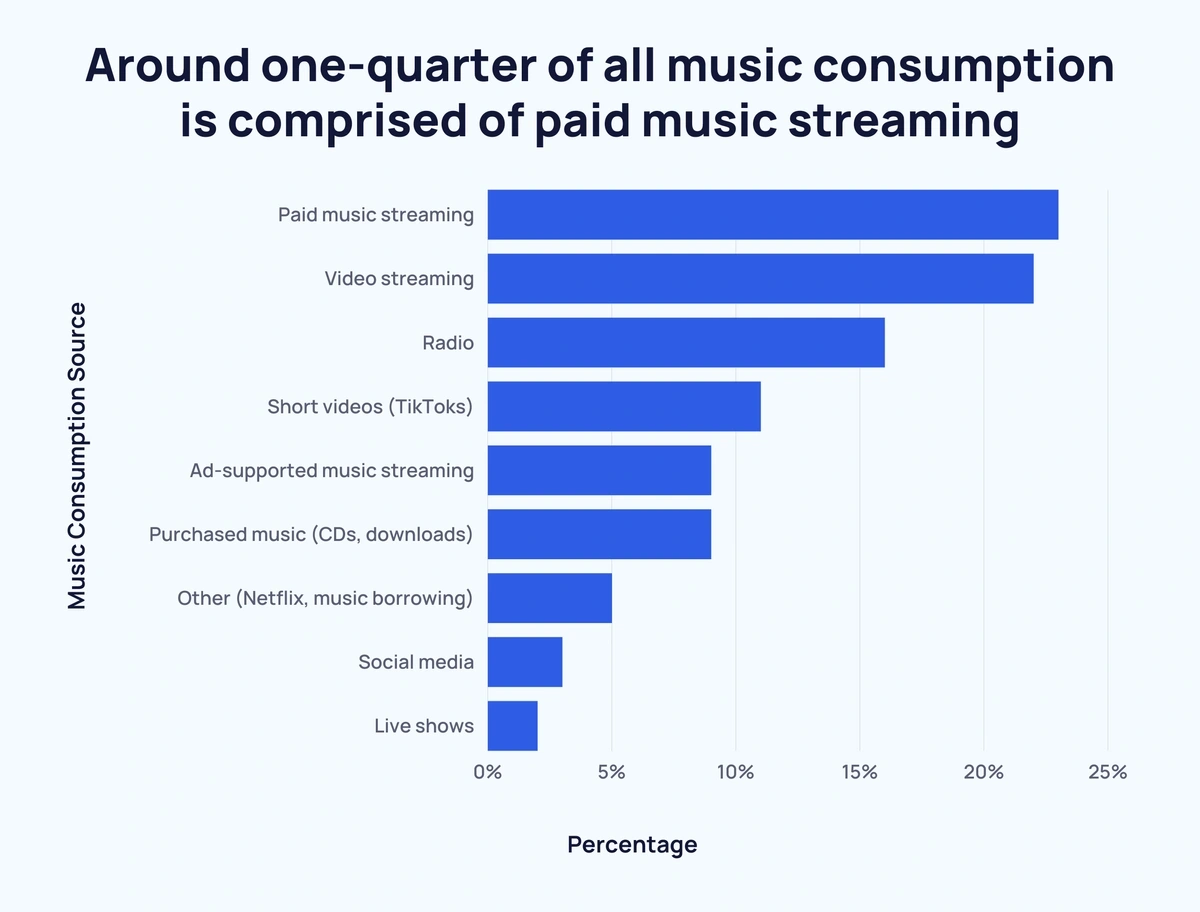

Around one-quarter of all music consumption is comprised of paid music streaming (IFPI)

Paid music streaming makes up 23% of all music consumption.

Here’s a breakdown of the most popular music sources:

| Music Consumption Source | Percentage |

| Paid music streaming | 23% |

| Video streaming | 22% |

| Radio | 16% |

| Short videos (TikToks) | 11% |

| Ad-supported music streaming | 9% |

| Purchased music (CDs, downloads) | 9% |

| Other (Netflix, music borrowing) | 5% |

| Social media | 3% |

| Live shows | 2% |

Music streaming platforms make up 67% of worldwide music industry revenue (IFPI)

Globally, 67% of total music industry revenue comes directly from music streaming platforms.

By comparison, just 16.1% of revenue now comes from physical sales.

Streaming accounts for 84% of US music industry revenue (IFPI, RIAA)

In the US, the reliance the music industry has on music streaming services is even more pronounced.

In total, 84% of US music industry revenue comes from music streaming, while physical sales are responsible for only 11%.

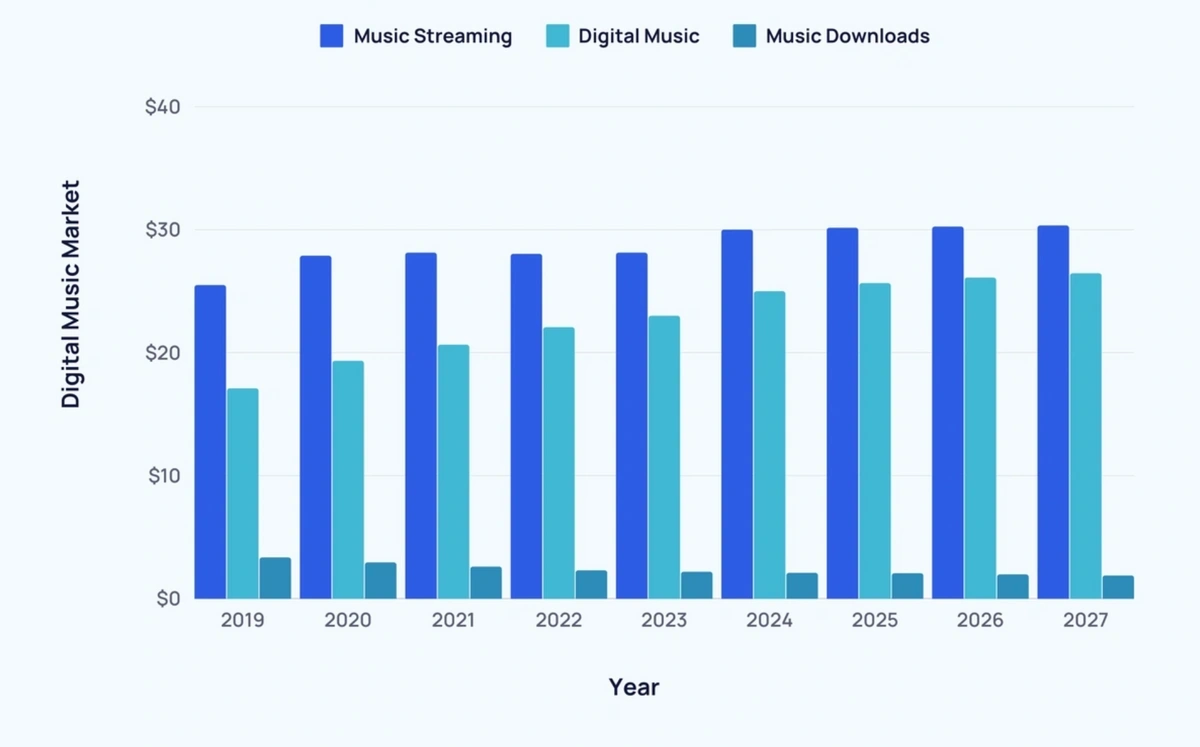

Music streaming revenue is predicted to hit $30 billion in 2027 (Statista)

Music streaming and digital music’s average revenue per user is expected to continue to increase over the coming years. However, figures are forecast to somewhat plateau.

Here’s a look at the digital music market forecast:

| Year | Music Streaming | Digital Music | Music Downloads |

| 2019 | $25.48 | $17.09 | $3.36 |

| 2020 | $27.87 | $19.33 | $2.96 |

| 2021 | $28.12 | $20.64 | $2.61 |

| 2022 | $28.02 | $22.06 | $2.32 |

| 2023 | $28.12 | $22.99 | $2.20 |

| 2024 | $29.99 | $24.98 | $2.11 |

| 2025 | $30.14 | $25.64 | $2.08 |

| 2026 | $30.24 | $26.10 | $1.98 |

| 2027 | $30.33 | $26.44 | $1.89 |

Music Streaming Users

Around 2 in 3 people listen to music using a streaming service (IFPI)

Approximately 67.3% listen to music using some form of music streaming service.

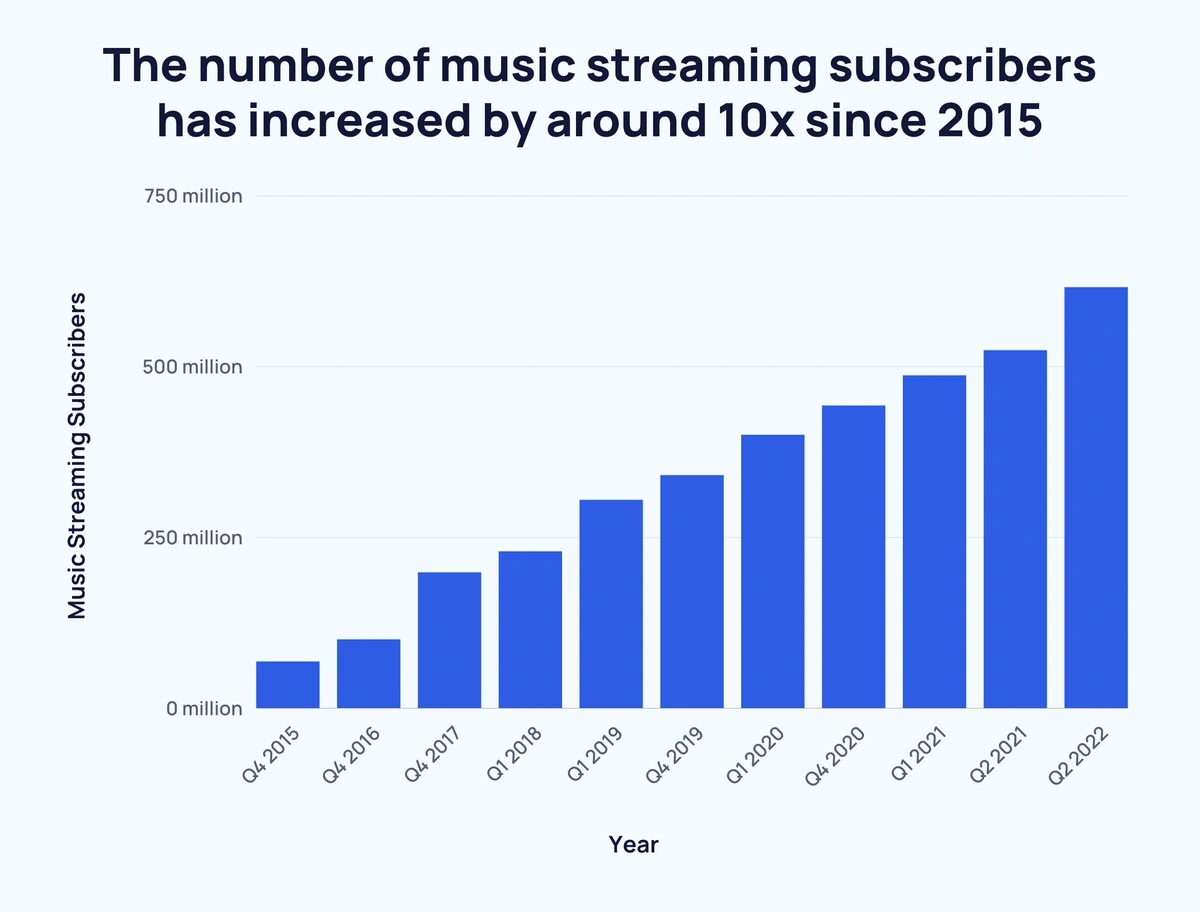

The number of music streaming subscribers has increased by around 10x since 2015 (IFPI, MIDiA Research)

Since Q4 2015, the number of music streaming subscribers has risen from 68 million to 616.2 million in Q2 2022 – an increase of almost 10x.

Here’s a breakdown of music streaming subscribers over time:

| Year | Music Streaming Subscribers | Increase Over Previous Year |

| Q4 2015 | 68 million | - |

| Q4 2016 | 100.4 million | +47.6% |

| Q4 2017 | 198.6 million | +97.8% |

| Q1 2018 | 229.5 million | +15.5% |

| Q1 2019 | 304.9 million | +32.8% |

| Q4 2019 | 341 million | +11.8% |

| Q1 2020 | 400 million | +17.3% |

| Q4 2020 | 443 million | +10.7% |

| Q1 2021 | 487 million | +9.9% |

| Q2 2021 | 523.9 million | +7.6% |

| Q2 2022 | 616.2 million | +17.6% |

Over 4 trillion songs were streamed in the US in 2023 (Music Business Worldwide)

Collectively, Americans streamed around 4.1 trillion songs in 2023 – up from 2022’s 3.4 trillion streams.

In total, over 80 million Americans use a premium streaming service to listen to music (RIAA)

Here are the numbers for US premium music service subscribers over time:

|

Year |

US Subscribers |

Increase Over Previous Year (%) |

Increase Over Previous Year (millions) |

|

2019 |

60.4 million |

- |

- |

|

2020 |

75.5 million |

↑ 25% |

↑ 15.1 million |

|

2021 |

84 million |

↑ 11.3% |

↑ 8.5 million |

|

2022 |

91.6 million |

↑ 9% |

↑ 7.6 million |

|

2023 |

96.8 million |

↑ 5.7% |

↑ 5.2 million |

Music Streaming Demographic

Around 3 in 5 of all 25 to 34-year-olds have an audio subscription service to stream music (IFPI)

62% of all 25 to 34-year-olds use audio subscription services for music listening.

And while older generations are less likely to have an audio streaming subscription, around 1 in 4 (28%) 55 to 64-year-olds do so.

Here are IFPI’s music subscription service figures by age bracket:

|

Age |

Proportion 2023 |

Proportion 2022 |

|

16-24 |

60% |

54% |

|

25-34 |

62% |

56% |

|

35-44 |

50% |

44% |

|

45-54 |

40% |

36% |

|

55-64 |

28% |

26% |

Almost all Gen Z Americans use a music streaming service (MCR)

Americans are among the most likely to stream music across all age brackets.

The difference across generations is often more pronounced in other countries.

For example, Americans listen to music using a streaming service in a typical week. This is compared to 98% for US Millennials, 96% for Gen X, and 89% for Boomers.

By comparison, 77% of Gen Z regularly listen to music using streaming services in the UK. And 79% of British Millennials also do so. However, the drop-off from there is far more dramatic, with only 67% of Gen Xers and 41% of Boomers using a music streaming service in a typical week.

Below, several nations’ music streaming habits are compared by generation:

| Nation | Gen Z | Millennials | Gen X | Boomers |

| Brazil | 87% | 89% | 73% | 63% |

| Mexico | 83% | 87% | 81% | 75% |

| Colombia | 84% | 88% | 76% | 69% |

| Argentina | 87% | 89% | 77% | 58% |

| Chile | 91% | 92% | 78% | 72% |

| France | 84% | 68% | 53% | 37% |

| Spain | 82% | 78% | 74% | 57% |

| UK | 77% | 79% | 67% | 41% |

| Italy | 77% | 76% | 59% | 40% |

| Germany | 83% | 78% | 59% | 37% |

| Japan | 89% | 70% | 51% | 34% |

| US | 99% | 98% | 96% | 89% |

Over half of Sweden’s population uses a paid music streaming service (IFPI)

According to IFPI, Sweden is the most engaged country in terms of paid music subscriptions with 61% of the population falling under this description.

Here are the top five nations:

- Sweden – 61%

- Mexico – 57%

- Germany – 55%

- USA – 53%

- New Zealand – 52%

Music Streaming Preferences

Ad-free listening is the top reason for paying for a music streaming platform (IFPI)

The top three reasons for choosing to use a paid music streaming service are:

-

Ad-free listening

-

Being able to choose what music to listen to

-

Access to large libraries of songs

The average listener spends over 20 hours listening to music each week (IFPI)

On average, listeners spend 20 hours and 42 minutes listening to music per week. That’s up 1 hour, and 42 minutes from 2021’s 18 hours, and 24 minutes.

Here are those figures broken down:

|

Year |

Hours per Day |

Hours per Week |

3-Minute Songs per Day |

3-Minute Songs per Week |

|

2021 |

2 hours 36 mins |

18 hours 24 mins |

52 |

368 |

|

2022 |

2 hours 54 mins |

20 hours 6 mins |

58 |

406 |

|

2023 |

2 hours 57 mins |

20 hours 42 mins |

59 |

414 |

The majority of users search for a specific song to listen to (IFPI)

In general, users prefer to take control when it comes to listening habits.

In total, 63% search for a particular song to listen to more than once a week.

Over half (57%) search for a specific artist. And 59% primarily listen to their own playlists.

Music Streaming Players

Over 100,000 songs are added to music streaming platforms daily (Music Business Worldwide)

Incredibly, approximately 120,000 new songs are added to music streaming services each day – that’s up almost 30% from 2022’s ~93,400.

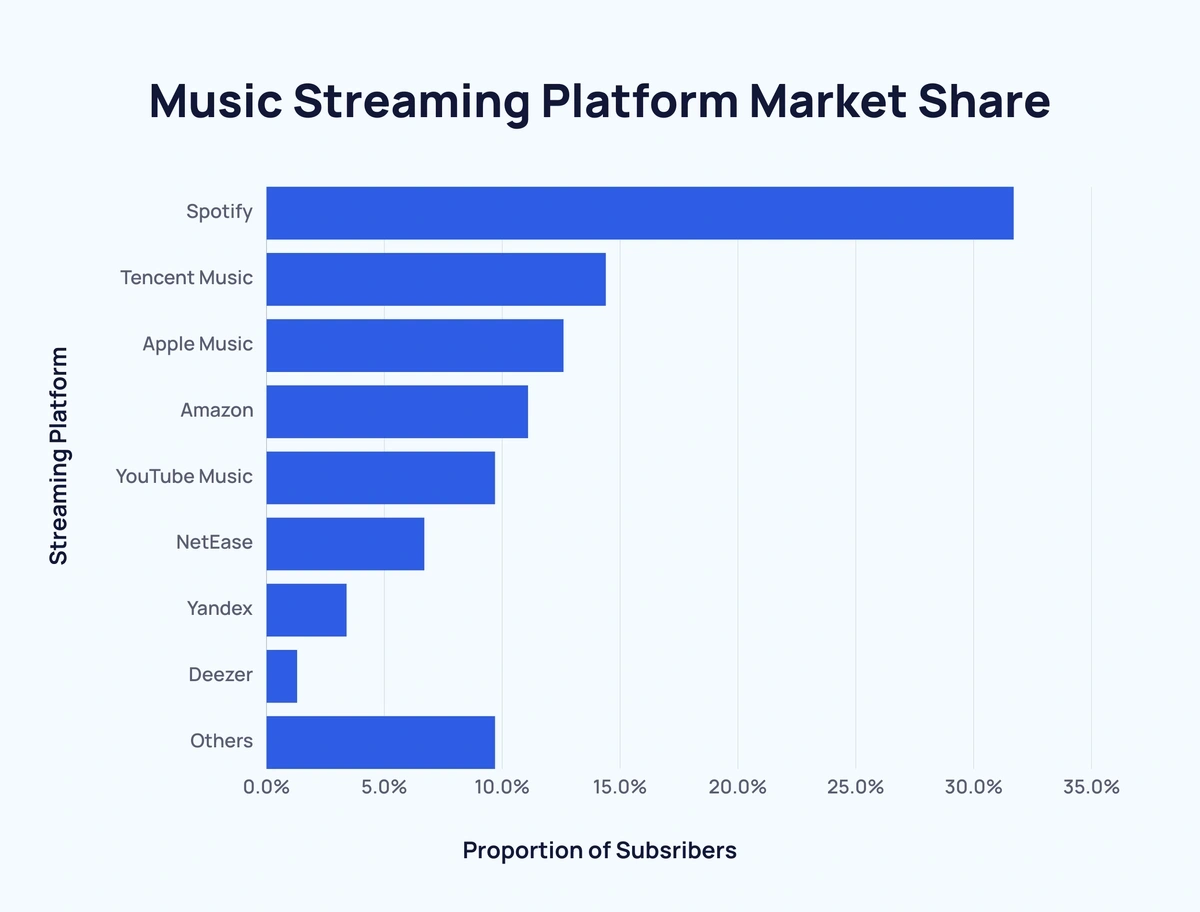

Spotify claims over 30% of the music streaming market share (MIDiA)

Spotify currently leads the way in the music streaming market with a 31.7% share.

Here’s a look at the music streaming industry by market share:

|

Streaming Platform |

Proportion of Subscribers |

|

Spotify |

31.7% |

|

Tencent Music |

14.4% |

|

Apple Music |

12.6% |

|

Amazon |

11.1% |

|

YouTube Music |

9.7% |

|

NetEase |

6.7% |

|

Yandex |

3.4% |

|

Deezer |

1.3% |

|

Others |

9.7% |

The standard monthly price for a music streaming subscription is $10 (Forbes)

Here’s how some of the top music streaming services compare in terms of monthly cost:

|

Streaming Service |

Monthly Cost |

|

Spotify Premium |

$10.99 |

|

Apple Music |

$10.99 |

|

Tidal |

$10.99 |

|

Amazon Music Unlimited |

$9.99 |

|

YouTube Music |

$10.99 |

Spotify Premium has well over 200 million subscribers (Backlinko, Spotify)

Spotify has increased its number of premium subscribers every quarter since 2015.

As of Q4 2023, there are approximately 236 million Spotify premium subscribers.

That means that with a total of 615 million monthly active users, around 38% of users choose to subscribe to Spotify Premium.

Here’s how the number of Spotify Premium subscribers has changed over time:

| Quarter | Spotify Premium Subscribers |

| Q1 2015 | 18 million |

| Q2 2015 | 22 million |

| Q3 2015 | 24 million |

| Q4 2015 | 28 million |

| Q1 2016 | 30 million |

| Q2 2016 | 36 million |

| Q3 2016 | 40 million |

| Q4 2016 | 48 million |

| Q1 2017 | 52 million |

| Q2 2017 | 59 million |

| Q3 2017 | 62 million |

| Q4 2017 | 71 million |

| Q1 2018 | 75 million |

| Q2 2018 | 83 million |

| Q3 2018 | 87 million |

| Q4 2018 | 96 million |

| Q1 2019 | 100 million |

| Q2 2019 | 108 million |

| Q3 2019 | 113 million |

| Q4 2019 | 124 million |

| Q1 2020 | 130 million |

| Q2 2020 | 138 million |

| Q3 2020 | 144 million |

| Q4 2020 | 155 million |

| Q1 2021 | 158 million |

| Q2 2021 | 165 million |

| Q3 2021 | 172 million |

| Q4 2021 | 180 million |

| Q1 2022 | 182 million |

| Q2 2022 | 188 million |

| Q3 2022 | 195 million |

| Q4 2022 | 205 million |

| Q1 2023 | 210 million |

| Q2 2023 | 220 million |

| Q3 2023 | 226 million |

| Q4 2023 | 236 million |

Spotify has more than double Apple Music’s subscribers (Business of Apps, Edison Trends)

Here’s a comparison between some of the biggest music streaming platforms (number of subscribers):

|

Subscribers |

||||||

|

Year |

Spotify |

Tencent Music |

YouTube Music |

Apple Music |

Amazon Music |

NetEase Music |

|

2016 |

36 million |

- |

3 million |

20 million |

- |

- |

|

2017 |

59 million |

- |

2.8 million |

27 million |

- |

- |

|

2018 |

83 million |

23.3 million |

10 million |

40 million |

16 million |

- |

|

2019 |

108 million |

31 million |

18 million |

50 million |

32 million |

6.7 million |

|

2020 |

138 million |

47.1 million |

30 million |

72 million |

55 million |

16 million |

|

2021 |

165 million |

60.9 million |

50 million |

80 million |

63 million |

26.1 million |

|

2022 |

188 million |

82.7 million |

80 million |

88 million |

74 million |

37.6 million |

|

2023 |

220 million |

106.7 million |

100 million |

93 million |

80 million |

44.1 million |

Most Popular Streamed Music

2023’s most popular song garnered approximately 1.6 billion streams (Nielsen)

Flowers by Miley Cyrus was the most popular song on music streaming platforms in 2023. The song accumulated around 1.6 billion streams – more than 2.5x 2021’s top song, Levitating by Dua Lipa (626.6 million).

Here’s a breakdown of the most popular songs by number of streams over time:

| Year | Song | Artist | Streams |

| 2018 | God’s Plan | Drake | 917.9 million |

| 2019 | Old Town Road | Lil Nas X | 1 billion |

| 2020 | The Box | Roddy Ricch | 920.4 million |

| 2021 | Levitating | Dua Lipa | 626.6 million |

| 2022 | As It Was | Harry Styles | 1.5 billion |

| 2023 | Flowers | Miley Cyrus | 1.6 billion |

For a second successive year, Bad Bunny’s Un Verano Sin Ti was the most listened-to album in 2023 with 4.5 billion streams.

Drake was the most-streamed artist of the decade with over 36 billion streams (chart data)

Across the 2010s, the most-streamed artists racked up 10s of billions of streams.

Here are the most successful artists of the 2010s in terms of streams:

| Rank | Artist | Streams |

| 1 | Drake | 36.3 billion |

| 2 | Post Malone | 18.9 billion |

| 3 | Eminem | 17.8 billion |

| 4 | Ariana Grande | 13.9 billion |

| 5 | Future | 13.9 billion |

| 6 | The Weeknd | 13.6 billion |

| 7 | Taylor Swift | 13.3 billion |

| 8 | XXXTentacion | 13 billion |

| 9 | Ed Sheeran | 12.9 billion |

| 10 | Rihanna | 12.8 billion |

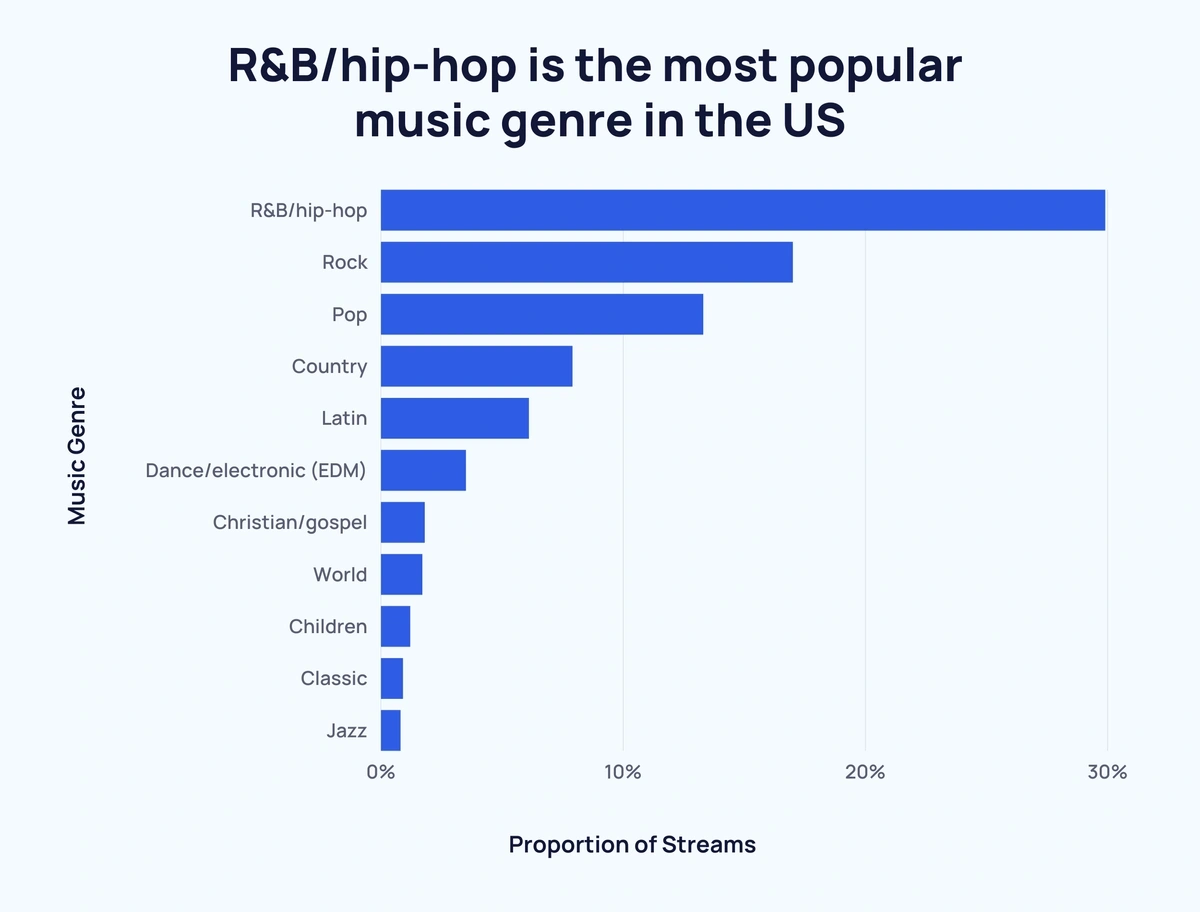

R&B/hip-hop is the most popular music genre in the US (Nielsen)

Almost 1 in 3 (29.9%) of songs streamed in the US fall into these genres - that’s almost 2x more than second-placed rock (17%).

Here’s a full breakdown of the most popular music genres in the US:

| Music Genre | Proportion of Streams |

| R&B/hip-hop | 29.9% |

| Rock | 17% |

| Pop | 13.3% |

| Country | 7.9% |

| Latin | 6.1% |

| Dance/electronic (EDM) | 3.5% |

| Christian/gospel | 1.8% |

| World | 1.7% |

| Children | 1.2% |

| Classic | 0.9% |

| Jazz | 0.8% |

Key Takeaways

It’s clear that music streaming continues to go from strength to strength.

And the industry is as reliant as ever on streaming services.

For more related content, have a look at Huge Streaming Trends and Video Streaming Services Stats.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Fabio is a research associate at Exploding Topics. Since 2021, Fabio has researched, written, and edited articles for the Explo... Read more